-

3 years ago

-

0

-

The Cup with Handle Pattern

Introduction

The cup with handle refers to a bullish continuation pattern where the upward trend has paused and declined, but will rise upon completion of the pattern. It can range from several months to a year, but its general form remains the same.

On bar charts, a cup and handle pattern bears a resemblance to its namesake, that is, a cup with a handle. The cup is shaped as a “U” while the handle has a slight downward slope. The right–hand side of the pattern generally has a low trading volume; it could be as short as 7 weeks or as long as 65 weeks.

The cup–and–handle pattern is preceded by an upward move, which pauses and sells off. The sell–off is the initial part of this pattern. After the sell–off, the security typically trades flat for a long period of time without any clear trend. The next part of the pattern comprises a rise towards the peak of the preceding upward move. The final part of the pattern, the handle, is a comparatively smaller downward move before the security continues the previous trend of moving higher.

Description of the Pattern

The cup with handle pattern has certain components that should be checked before confirming the pattern.

Trend

There should be a prior trend in a cup with handle pattern. Typically, the trend should be a few months old and not too mature. This is because the more mature the trend, the less likely it is that the pattern shows continuation or less upside potential. A larger prior trend reduces the chances of a large breakout after the pattern has been completed. This is because much of the run–up in the security then occurs before the formation of the cup, which weakens the size of a possible upward move.

Cup

The cup needs to be U–shaped and look like a bowl or rounding bottom, similar to a semi–circle. This is because a cup and handle pattern marks a consolidation within a trend, with weaker investors leaving the market and new buyers and determined holders staying in the security. If the shape of the cup is too sharp (“V” shape), it is not a true consolidation phase in the upward trend.

The softer shape of U confirms that the cup is a consolidation pattern with strong support at the bottom of the “U”. Ideally, the pattern has equal highs on both sides of the cup. However, this may not always be the case.

The cup’s height also demands attention. A typical cup with handle pattern is between one–third and two–thirds the size of the previous upward movement, based on market volatility. For instance, if the prior trend was $10 to $35, the height of the cup needs to be $8 (roughly $25 x 33%) to $16 (roughly $25 x 66%). The height of the cup can also be used as an initial price target after the pattern completes itself and there is a breakout.

Handle

The handle essentially completes the pattern. It is the pullback or downward move by the security following the upward move on the right side of the cup. Notably, the handle represents the final consolidation before the big breakout. Typically, the handle’s downward movement can retrace up to one–third of the gain made in the right side of the cup but not more. A small retracement indicates a bullish formation and a significant breakout.

During the downward move of the handle, a declining trendline can be drawn, which is an indicator of the breakout. If there is a move by the security above this descending trendline, it signals that the previous upward trend is about to begin. At times, it is judicious to wait for a break above the resistance line formed by the highs of the cup.

Duration

In the cup with handle pattern, the cup can last for 1–6 months and sometimes even longer. The handle can extend from 1 week to many weeks and typically completes within 1–4 weeks.

Volume

There should be a considerable increase in volume on the breakout above the handle. The most important area of focus of this pattern is the breakout. The greater the volume on the upward breakout, the surer you can be that the upward trend will continue. Similar to the head–and–shoulders pattern, the stock price may move back to the trendline to test the support. The volume is vital for confirming the pattern.

Target

The projected rise after breakout is expected at 9 points from the breakout around 32.

Conclusion

Over the years, basic human nature has remained the same. Emotions such as hope, despair, greed and fear as well as the laws of supply and demand drive stock prices. Hence, the cup with handle pattern occurs time and again.

Among the eight principal base patterns, namely, the flat base, double bottom, saucer, base on base, ascending base, IPO base, and high, tight flag, the cup with handle is one of the most successful. It helps the investor be better prepared for the stock market.

Reference Links:

https://www.investopedia.com/university/charts/charts3.asp

https://www.investopedia.com/terms/c/cupandhandle.asp

https://tradingsim.com/blog/how-to-trade-the-cup-and-handle-pattern/

https://www.tradingview.com/ideas/cupandhandle/

http://www.nasdaq.com/article/principles-of-technical-analysis-the-cupandhandle-pattern-cm29628

http://thepatternsite.com/cup.html

https://chart-patterns.netfirms.com/cup.htm

Browse Categories

Featured Posts

3 years ago

3 years ago

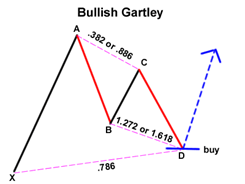

Cypher Pattern

3 years ago

3 years ago

Crab Pattern

3 years ago

3 years ago

Butterfly Pattern

3 years ago

3 years ago

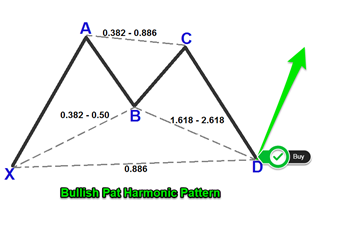

Bat Pattern

3 years ago

3 years ago

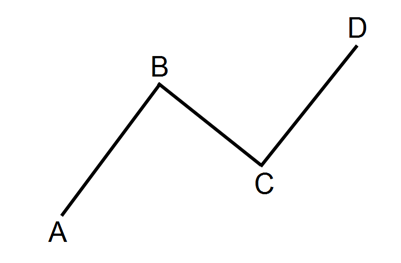

ABCD Pattern

3 years ago

3 years ago

The Rectangle Pattern

3 years ago

3 years ago

Triangle Patterns

3 years ago

3 years ago

Flag Pattern

3 years ago

3 years ago

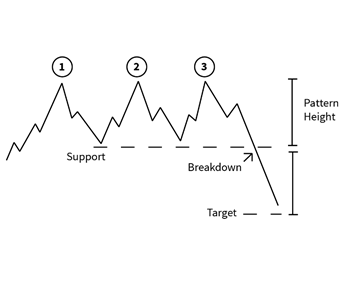

Double and Triple Pattern

3 years ago

3 years ago

The Cup with Handle Pattern

3 years ago

3 years ago

The Head-and-Shoulders Pattern

Popular Posts

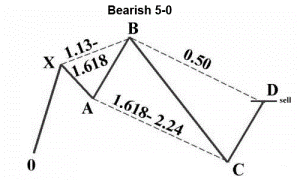

Five O (or 5-0) Pattern

3 years ago

Crab Pattern

3 years ago

Butterfly Pattern

3 years ago