-

3 years ago

-

0

-

Bat Pattern

Introduction

In trading, the Bat pattern is a 5-point retracement structure. It was developed by Scott Carney in 2001 in his book The Harmonic Trader. This pattern has particular Fibonacci measurements for each point within its structure.

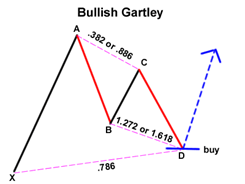

It is held to be one of the more accurate patterns and has a greater success rate than any other harmonic pattern. Though the Bat pattern looks similar to the Gartley 222 Butterfly pattern, it differs a little in terms of the Fibonacci ratios between the swing or pivot points.

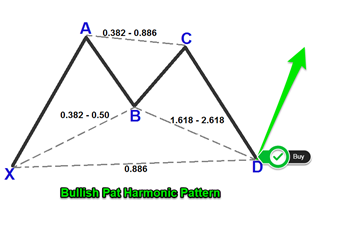

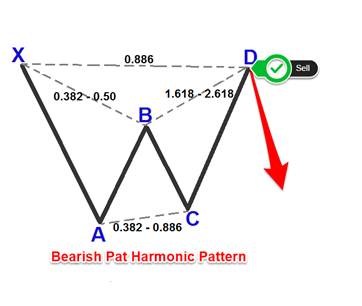

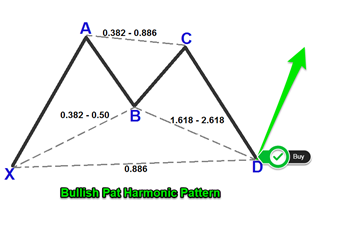

This harmonic pattern is made up of 5 swing points – X, A, B, C and D, and have bullish and bearish variations.

Description

The Bat is a four-leg reversal pattern that conforms to specific Fibonacci ratios. A proper Bat pattern needs to satisfy the following criteria:

- AB needs to be a minimum of 38.2% and maximum of 50% Fibonacci retracement of XA

- BC needs to be a minimum of 38.2% and maximum of 88.6% Fibonacci retracement of AB

- CD needs to be an 88.6% Fibonacci retracement of XA or 1.618–2.618% Fibonacci extension of AB

To identify the Bat pattern, you have to first look for the XA leg, which is impulsive. Depending on whether you spot a strong upward or downward movement, you will have a bullish or bearish Bat structure.

There should also be a minimum of 0.382 Fibonacci retracement of the XA leg. It could also be up to 0.50 Fibonacci retracement of XA, but it cannot be below 0.618. This will lead to formation of the B leg of the pattern.

For the third point C, you want to look for a retracement of AB up to at least 0.382 Fibonacci ratios. However, it cannot rise above 0.886.

Finally, for locating the D point, you want to find the 0.886 Fibonacci ratios of the impulsive XA leg. This will lead to formation of a deep CD leg that will complete the Bat pattern.

Given below are the bullish and bearish Bat patterns:

Rules of Trading in this Pattern

Identify point D, which will be 88.6% retracement of X-A. You want to enter the market at this point and place a buy or sell order here, depending on whether the Bat pattern is bullish or bearish.

Then you want to place your stop loss just below point X.

This is followed by placing your profit target. The point where you place your profit target depends on the market scenario and your trading objectives.

You could draw a new Fibonacci retracement from point A to D of the completed pattern. Once this is done, consider putting your profit target at 61.8% retracement level of A-D.

It is noteworthy that you can only make the Fibonacci retracement once the pattern is complete at point D and the share price has reversed.

Conclusion

The Bat pattern is, therefore, a continuation pattern which occurs when a trend reverses direction for a short while before continuing its original course.

It gives you the chance to enter the market when the stock is at a good price, just as the pattern ends and the trend resumes. The Bat pattern strategy is effective because it has well-tested support and resistance levels, which are mostly quite sharp. It has a high success rate and needs a comparatively small stop loss than most other harmonic patterns.

Source Links:

https://tradingstrategyguides.com/harmonic-bat-pattern-strategy/

https://www.tradingview.com/ideas/batpattern/

http://www.profitf.com/articles/patterns/harmonic-pattern-bat/

https://www.investopedia.com/articles/forex/11/harmonic-patterns-in-the-currency-markets.asp

http://stockcharts.com/school/doku.php?id=chart_school:trading_harmonic_patterns

http://forextraininggroup.com/using–the–harmonic–abcd–pattern–to–pinpoint–price–swings/

http://www.forexabode.com/forex–school/watch–out–for–patterns/rectangles/

https://learn.tradimo.com/advanced–chart–patterns/bullish–rectangle

Browse Categories

Featured Posts

3 years ago

3 years ago

Cypher Pattern

3 years ago

3 years ago

Crab Pattern

3 years ago

3 years ago

Butterfly Pattern

3 years ago

3 years ago

Bat Pattern

3 years ago

3 years ago

ABCD Pattern

3 years ago

3 years ago

The Rectangle Pattern

3 years ago

3 years ago

Triangle Patterns

3 years ago

3 years ago

Flag Pattern

3 years ago

3 years ago

Double and Triple Pattern

3 years ago

3 years ago

The Cup with Handle Pattern

3 years ago

3 years ago

The Head-and-Shoulders Pattern

Popular Posts

Five O (or 5-0) Pattern

3 years ago

Crab Pattern

3 years ago

Butterfly Pattern

3 years ago