-

3 years ago

-

0

-

The Shark Pattern

Introduction

Among harmonic patterns, the Shark pattern is a 5–point reversal structure that Scott Carney discovered in 2011.

It is a combination of Fibonacci numbers and the Elliott Wave theory. It is a five–point pattern formation. It is a 5–point reversal structure that Scott Carney discovered in 2011.

Essentially, the Shark consists of an impulse leg and a retracement leg, with the latter not having any particular value. The continuation leg needs to have a 113% Fibonacci extension of BA, but it should not exceed 161.8%.

The Shark pattern helps retest prior support and resistance points as a strong counter–trend reaction. It is a temporary extreme structure that takes advantage of the extended nature of the Extreme Harmonic Impulse Wave.

Description

The Shark pattern is similar to the Bat Pattern, with the exception that point C exceeds the BC leg. A comparatively lesser known harmonic pattern, it is effective if executed properly.

General Rules of Trading in the Shark Pattern

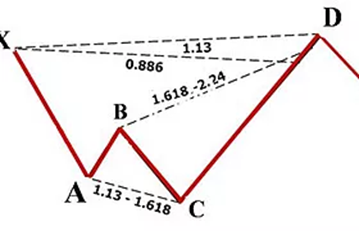

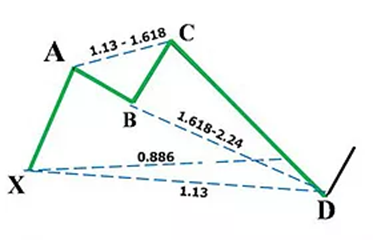

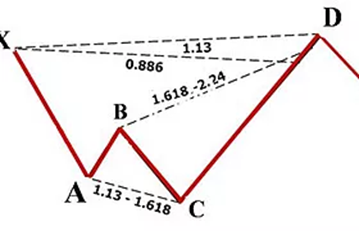

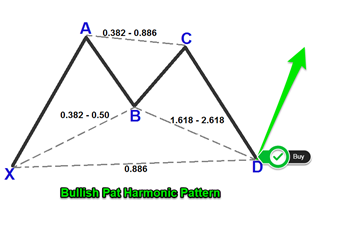

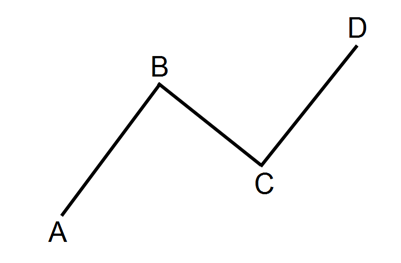

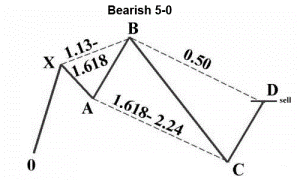

- A typical Shark pattern consists of an impulse leg (XA) that is followed by a retracement leg (B) without any specific value. This is followed by a continuation leg (C) that has to reach at least 113% Fibonacci extension of BA leg without crossing 161.8%.

- Then, you need to draw a Fibonacci retracement of X to C. The pattern must reach 88.6% of the XC Fibonacci retracement and cannot cross the XC 113% extension.

- The BC Fibonacci extension needs to be drawn next. The key to this pattern is the 161.8 extension of the BC extension. It must reach a minimum of 161.8 and cannot exceed 224%.

- The area in which the BC Fibonacci extension and XC Fibonacci retracement overlap is called the Potential Reversal Zone (PRZ). It is the zone where you want to enter trades.

- The PRZ is defined by a 0.886 retracement of the initial leg and a 1.13 reciprocal ratio of the initial leg.

- The target stops can be various retracements of the CD leg, all the way up to C itself. There are different means of determining the most appropriate position for the target stop. You could put it beyond the next structure level after point D, or opt for the 1.41 extension of XA.

Even if the candle closes slightly above or below the boundaries, the pattern is still a valid one. Scott advocates a 3% rule whereby the candle close should not cross the boundaries by over 3%.

As with all harmonic patterns, the Shark pattern can either be bullish or bearish:

Bullish Shark

Bearish Shark

As a conservative trader, you may want to look for additional confirmation before entering a trade based on an indicator value and a specific candlestick pointing toward a reversal or a combination of other methods. The Shark pattern is as effective as other harmonic patterns. One of the common variations on trading this pattern is to complete the last leg.

Conclusion

The Shark pattern is a comparatively new harmonic pattern with a relatively high success rate. It demands immediate change in the character of stock price action immediately following pattern completion. The extreme harmonic impulse wave to be utilized depends on the location of the 88.6% level. The pattern requires a keen observation and an active management to capture the high probability profit segments.

Source Links:

https://www.tradingview.com/ideas/5–0pattern/

https://www.tradingview.com/chart/EURNZD/QVJaBrry–This–is–How–the–5–0–Pattern–Looks–Like–forex/

https://www.orbex.com/blog/2017/03/catch–key–reversals–5–0–pattern

http://strategy4forex.com/trading–on–the–forex–graphical–models–and–patterns/pattern–5–0.html

http://konn7.com/fx/The5–0Pattern.pdf

http://www.autochartpatterns.com/shark–5–0–patterns/

Browse Categories

Featured Posts

3 years ago

3 years ago

Cypher Pattern

3 years ago

3 years ago

Crab Pattern

3 years ago

3 years ago

Butterfly Pattern

3 years ago

3 years ago

Bat Pattern

3 years ago

3 years ago

ABCD Pattern

3 years ago

3 years ago

The Rectangle Pattern

3 years ago

3 years ago

Triangle Patterns

3 years ago

3 years ago

Flag Pattern

3 years ago

3 years ago

Double and Triple Pattern

3 years ago

3 years ago

The Cup with Handle Pattern

3 years ago

3 years ago

The Head-and-Shoulders Pattern

Popular Posts

The Cup with Handle Pattern

3 years ago

Five O (or 5-0) Pattern

3 years ago

Crab Pattern

3 years ago