-

4 years ago

-

0

-

Algorithmic Trading

Introduction

An algorithm is a particular set of well-defined instructions aimed to successfully execute a task or process. Algorithmic trading, also known as algo-trading, automated trading or black-box trading, uses computers which are programmed to follow a specific set of instructions. The computers are employed to garner profits at a frequency and speed surpassing that of a human trader.

The defined set of rules, according to which these computers run, are based on price, quantity, timing or any mathematical model. Algo-trading has multiple benefits such as more liquidity for the market, greater opportunities for profit and more systematic trading by precluding any emotional human effect on trading activities.

Therefore, algorithmic trading involves employs fast computer programs and complex algorithms to formulate trading strategies for maximum returns.

Why is Algorithmic Trading Important?

Certain trading and investment strategies such as intermarket spreading, market making, arbitrage and speculation can be improved through algorithmic trading. Electronic platforms can completely operate investment and trading strategies through algorithmic trading. This kind of trading can also be used by electronic platforms to execute investment schemes. Notably, complex algorithms enable investors to obtain the best returns without increasing purchasing costs and significantly affecting the stock’s price.

Benefits of Algorithmic Trading

- Trades can be carried out at the best possible price.

- Trades are timed properly and instantly to avoid considerable stock price change.

- Transaction costs are reduced due to the absence of human intervention.

- Chances of human mistakes based on psychological and human factors are reduced.

- The risk of manual errors in placing trades is lowered.

- It leads to accurate placement of trade orders.

- By engaging in high frequency trading (HFT), it can place several orders over multiple markets and multiple parameters at an extremely fast speed based on programmed instructions.

Who Can Gain from Algorithmic Trading?

- Short-term traders and sell side participants such as speculators, arbitrageurs and market makers benefit from the liquidity that is created for sellers in the market.

- Mid- to long-term investors or buy side firms such as mutual funds, insurance companies and pension funds that purchase shares in huge quantities but want to avoid influencing the stock price with their large-volume investments can gain effectively.

- Systematic traders such as pairs traders, trend followers and hedge funds find it more convenient to put their trading rules in a program and then let the program execute trade automatically.

Disadvantages of Algorithmic Trading

- Algorithmic swings can cause extreme swings and flash crashes in the market. When the stock price marks main milestones such as a 200-day moving average or a 52-week high or low, algos may cause a large volume of trades to enhance the trend.

- The stock exchanges where algos are used have to assign a unique identifier to each for better surveillance by institutional watchdogs. This can often pose to be a hassle.

- There are risks and challenges in algorithmic trading such as network connectivity errors, time gaps between trade orders and execution, imperfect algorithms and system failure risks.

- Since any market participant can place an auto-generated trade, prices can swing in milli- and even microseconds, thereby subjecting algorithmic trading to risk.

- The greater the complexity of an algorithm, more is the stringency of the back-testing before it is put into action. This can sometimes prove to be tiring.

Why Algorithmic Trading Needs Attention

Although you may not use algos, it is helpful to know how they are deployed in the market. A primary concern with algos is that in case of a bug in the programme, there can be losses to thousands of investors. Algorithmic trading involves speed in transactions but too much of speed can be dangerous for investors in the market.

Notably, algorithmic trading is distinct from methods based on a human trader’s instinct or intuition. It presents a systematic approach to trading.

Prerequisites for Algorithmic Trading

- A computer program that is capable of reading the market prices

- A forex rate feed for facilitating the exchange rate

- Order-placing capacity which can direct the order to the correct exchange

- Capability to back-test based on historical price feeds

Conclusion

Algorithm trading, therefore, facilitates speedy and accurate decision-making in financial markets with advanced mathematical tools. Since the need for a human trader’s intervention is minimized, decisions can be made quickly. The system is able to capitalise on profit-making opportunities before a human trader notices them. As large institutional investors deal with a great amount of shares, they are the ones who widely use algorithmic trading. Over the last few years, this kind of trading has become popular.

Source Links:

https://www.investopedia.com/terms/a/algorithmictrading.asp

https://en.wikipedia.org/wiki/Algorithmic_trading

https://economictimes.indiatimes.com/definition/algorithm-trading

https://www.motilaloswal.com/article.aspx/1035/Algorithmic-trading-and-why-its-worth-exploring

Browse Categories

Featured Posts

4 years ago

4 years ago

Cypher Pattern

4 years ago

4 years ago

Crab Pattern

4 years ago

4 years ago

Butterfly Pattern

4 years ago

4 years ago

Bat Pattern

4 years ago

4 years ago

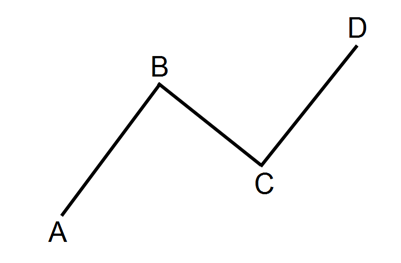

ABCD Pattern

4 years ago

4 years ago

The Rectangle Pattern

4 years ago

4 years ago

Triangle Patterns

4 years ago

4 years ago

Flag Pattern

4 years ago

4 years ago

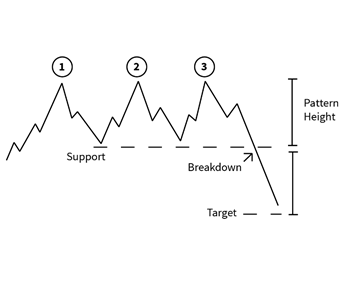

Double and Triple Pattern

4 years ago

4 years ago

The Cup with Handle Pattern

4 years ago

4 years ago

The Head-and-Shoulders Pattern

Popular Posts