-

4 years ago

-

0

-

Cypher Pattern

Introduction

It was Darren Oglesbee who discovered the Cypher pattern in trading. Visually, it is an inverse pattern of the Butterfly. Technically an advanced formation, the Cyber structure has particular Fibonacci measurements for each point. Though it works on any time frame and market, to be on the safe side, it is advisable to choose higher time frames.

It does not occur as frequently as the Butterfly and is unique as it is defined by specific rules.

Description

The Cypher pattern has a typical extension where point C goes much beyond point A. This structure is considered to have a high success rate.

Although the occurrence of the Cypher pattern is rare, it is not a high probability setup. You need to make adjustments to the Fibonacci levels since this structure is not often spotted.

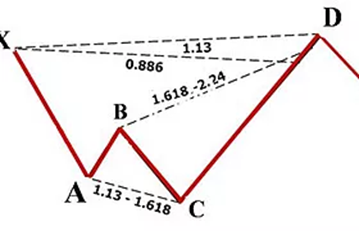

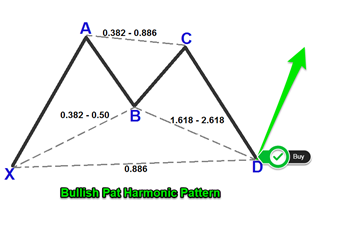

There are two versions of the pattern, namely, bullish and bearish. The bullish pattern looks like the skewed letter “M” while the bearish one appears like the skewed letter “W”. Below are the images of the bullish and bearish Cypher patterns:

General Rules of Trading in the Cypher Pattern

The Cypher pattern begins to form when points X and A are established on the stock price. The pattern starts to evolve once this leg is determined.

Point B retraces 0.382–0.618 Fibonacci level of XA.

Point C is formed when the stock price extends the XA leg by at least 1.272 or within 1.130–1.414 of the Fibonacci extension level.

On the retracement of 0.782 Fibonacci level of XC, point D is formed. You can also expect the price to reverse at point D.

The targets can be placed at 0.382 and 0.618 Fibonacci retracement levels of CD.

Stop losses are placed a few notches below or above the high or low of point X.

The stop generally goes beyond the next structure support or resistance beyond the X–point. If you are a conservative trader, however, you may want to look for additional information to confirm the pattern before entering trade.

The Cypher pattern, therefore, begins with an impulse leg, a small correction and then extension of the impulse leg followed by a big correction.

Conclusion

The Cypher pattern is a trend continuation pattern. The stop loss is usually placed a few steps below or above the farthest possible D level. For a safe target, you want to focus on 38.2–61.8% of the CD leg. You want to enter the market with a limit order or a price that reverses from D. Remember that the ratio line between A and C signifies how far C extends the XA leg.

It is noteworthy that all entries need to be tested for the risk/reward ratio. Those with low risk/reward ratio can either be rejected or need to be treated carefully. Among all the harmonic patterns, the Cypher is perhaps the most exciting as its winning rate is the highest. However, waiting for the perfect Cypher pattern requires patience and the trader has to observe the price chart for a long time before he/she is sure of the validity of the setup.

Source Links:

https://www.tradingview.com/ideas/cypherpattern/

https://tradingstrategyguides.com/best–cypher–patterns–trading–strategy/

https://chartpatternanalytics.com/trading–chart–patterns/cypher–pattern/

http://www.profitf.com/articles/patterns/forex–cypher–pattern/

Browse Categories

Featured Posts

4 years ago

4 years ago

Cypher Pattern

4 years ago

4 years ago

Crab Pattern

4 years ago

4 years ago

Butterfly Pattern

4 years ago

4 years ago

Bat Pattern

4 years ago

4 years ago

ABCD Pattern

4 years ago

4 years ago

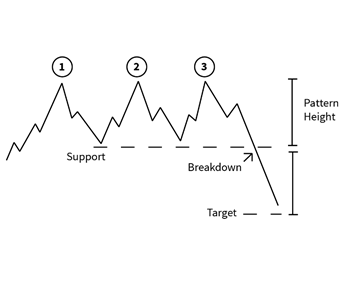

The Rectangle Pattern

4 years ago

4 years ago

Triangle Patterns

4 years ago

4 years ago

Flag Pattern

4 years ago

4 years ago

Double and Triple Pattern

4 years ago

4 years ago

The Cup with Handle Pattern

4 years ago

4 years ago

The Head-and-Shoulders Pattern

Popular Posts

Algorithmic Trading

4 years agoAn Overview of Initial Coin Offering (ICO)

4 years agoMonero Cryptocurrency

4 years ago