-

4 years ago

-

0

-

Order Flow

Introduction

In futures trading, it is important to know how markets facilitate order flow and volume. At any specific point, a large number of traders are initiating trade or placing orders for various reasons. Some may be buying shares as a long–term investment, some may be selling to earn a speedy profit, while others may be placing orders to enter the market at favourable prices. Therefore, the forex market is a continuous flow of orders.

The stock price is essentially the value that everyone agrees on at that particular point. The price indicates all the known information in the world at the moment. When any new information enters the market, it instigates participants to react based on their expectations. This causes the stock price to fluctuate, reflecting the changed consensus. It is mainly the interplay between the market and market orders that constitute order flow.

Description

Order flow trading is basically a type of market analysis which concentrates on how other traders in the market make decisions.

The concept is that if you can gauge when and where traders are likely to place trades, the direction in which the market is likely to move can be determined. Order flow trading is not new but there has been difficulty regarding how it works in comparison to other trading strategies. The key is to anticipate the prices where other traders have pending orders, specifically those who are important market participants with very large orders.

It is not possible to trade order flow without “picking levels”. Typically, trading veterans advise against picking levels as it involves risk. However, if you think more cautiously about the levels you pick and use stop losses, order flow trading can be advantageous.

Volume Profile

We are generally conditioned to use charts because all authorities in stock trading – be it an educational forum or trading book – are focused on charts. While charts help locate the support and resistance points and possible stop locations, they don’t offer complete certainty. At the end of the day, it is all about what generates order flows.

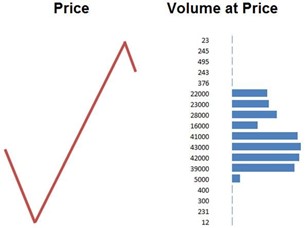

Order flow trading does not use charts. The trader looks at the “Volume at Price” or “Volume Profile,” indicating the total number of contracts traded at each price for the present trading session.

How it Works

In traditional chart–based analysis, the low and high swings are considered possible support and resistance points. The volume profile, however, is different. From the figure, it is clear that the top five prices have very few contracts traded. So, there are very few positions existing there. Likewise, the bottom four prices have very few contracts that have been traded. The notable areas are those where most of trading took place.

At the top of the high–volume area of the volume profile, there are 22,000 contracts. These are far more important than the 23 contracts traded at the highest price. These numbers represent trades. So, the number of contracts traded indicates the number of contracts that were sold and bought. In this case, it is 22,000. Now, all the buyers and sellers are motivated by different reasons:

So, among the 22,000 buyers and sellers, the following traders will be there:

People Closing Positions – These traders are not our concern as they will not be compelled to react to price movements in the near term.

Long–Term Positions – These traders will not react to short–term price fluctuations. They are keen on setting up long–term positions and will not react to intra–day fluctuations, unless a major correction takes place suddenly.

Arbitrage or Spread Traders – These traders are seen to enter trade in and out intraday, but their positions straddle two or more markets. They trade the relationship between these markets, in the process simply watching and not reacting to any price movement in only one of the markets in their industry.

Short–Term, Intraday Traders – They constitute the bulk of trading in several markets. These traders generally react to short–term price movements. Their reactions are reasonably predictable and apparently visible as well.

Though this is a simplification of the scenario, the bottom line is that we need not bother about long–term traders and arb/spread traders due to their unpredictable reactions to short–term price fluctuations. Traders who have just exited the market are not to be taken seriously as well. It is primarily the positions of short–term, intraday traders that indicate intraday moves. At times, however, a one–way, high–volume news may drive institutional buying or selling, which moves the stock price in a specific direction. However, such instances are rare.

Conclusion

Order flows become easier to understand when you carefully analyse them. They help you become aware of how the price moves and in which direction it is likely to move. Your knowledge about other traders and the market scenario will help you take advantage of these opportunities in live trading.

Source Links:

http://www.smbtraining.com/blog/why–is–order–flow–important

http://optimusfutures.com/tradeblog/archives/order–flow–fundamentals/

https://www.elitetrader.com/et/threads/market–profile–order–flow.185028/

https://futures.io/articles/trading/Order–Flow

https://forums.babypips.com/t/order–flow–trading/50755/2

http://orderflowforex.com/trading–without–charts/

Browse Categories

Featured Posts

4 years ago

4 years ago

Cypher Pattern

4 years ago

4 years ago

Crab Pattern

4 years ago

4 years ago

Butterfly Pattern

4 years ago

4 years ago

Bat Pattern

4 years ago

4 years ago

ABCD Pattern

4 years ago

4 years ago

The Rectangle Pattern

4 years ago

4 years ago

Triangle Patterns

4 years ago

4 years ago

Flag Pattern

4 years ago

4 years ago

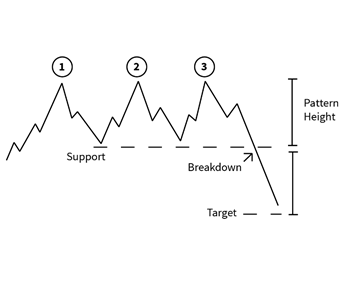

Double and Triple Pattern

4 years ago

4 years ago

The Cup with Handle Pattern

4 years ago

4 years ago

The Head-and-Shoulders Pattern

Popular Posts

Butterfly Pattern

4 years ago