-

4 years ago

-

0

-

Three Drives Pattern

Introduction

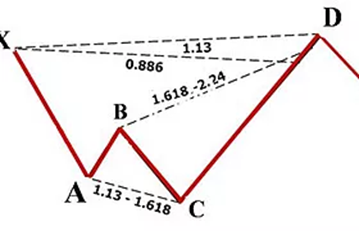

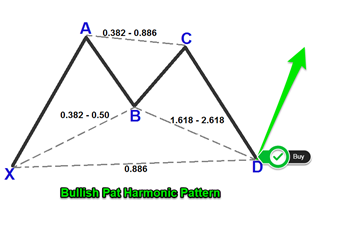

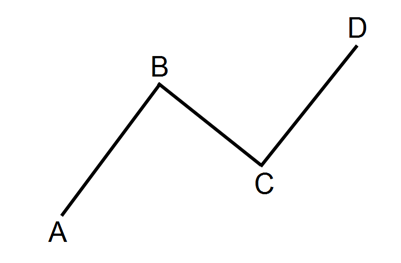

Among harmonic chart patterns, the Three Drives pattern is a well-known one. It is essentially a reversal pattern that is typified by a series of higher highs or lower lows. A relative of the ABCD pattern, it was mentioned in Robert Prechter‘s renowned book Elliot Wave Principle.

This pattern can signal that the market is exhausted in its present move and a possible reversal is about to take place on the price chart. The bullish version of the Three Drives pattern can help to identify possible buy opportunities while the bearish version can help to identify possible sell opportunities for the stock trader.

Description

In Elliot Wave Principle, Pretcher says that the general nature of price action has either a three-wave or a five-wave structure. In an adaption of this principle, the Three Drives pattern consists of symmetrical price movements possessing identical Fibonacci projections in a 5-wave price structure. In Scott M. Carney’s book The Harmonic Trader, the importance of the Three Drives pattern in identifying larger retracements and projections is outlined. This helps improve the accuracy of the pattern while trading it.

The pattern constitutes a series of three higher highs or lower lows, which indicates a potential reversal. In some cases, the reversal can be a significant move as it releases the pressure that has long been built up. However, this is not always the case.

Identifying the Three Drives Pattern

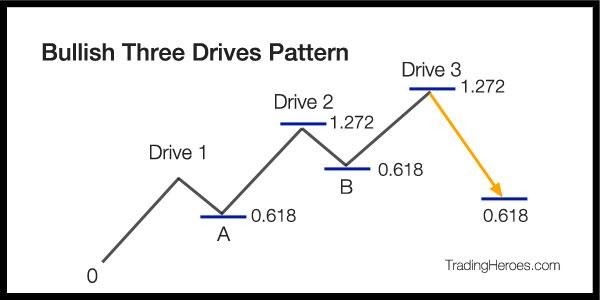

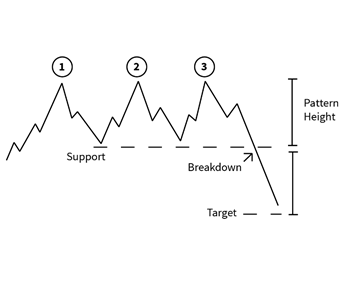

- Bullish Three Drives

In the bullish version of the pattern, the stock price initially marks a low at point 1, which is the first drive of the pattern. This is followed by a retracing of the price before dropping to a new low at point 2. This forms the second drive. The second low needs to be a 127% or 161.8% Fibonacci extension of the first drive. After this, the price retraces again to make a third drive. This third drive is the most important as it is here that you want to look to make a long entry.

Ideally, your target should be the 0.618 retracement of the entire move, starting from point zero to the top of drive 3.

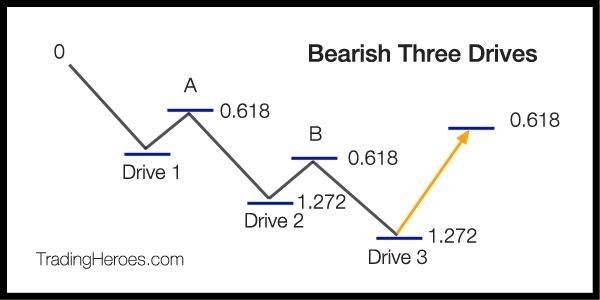

- Bearish Three Drives

In the bearish version of the pattern, the price rises to an initial high at point 1, which is the first drive of the pattern. Then, the price retraces before making a new high at point 2. This forms the second drive and needs to be a 127% or 161.8% Fibonacci extension of the first drive. This is followed by the price retracing once again to rise up to a third drive, which should be a 127% or 161.8% Fibonacci extension of the second drive. As with the bullish pattern, in the bearish pattern too, it is the third drive that demands the most attention as this is where you seek to make a short entry.

Trading in the Three Drives Pattern

In the Three Drives pattern, traders generally look to enter the market on the third drive as it offers the most precise entry point with the highest potential to earn profit. This will either be a 127% or 161.8% Fibonacci extension. There are essentially three ways in which you could enter a trade:

- Put in a pending order at the last 1.272 level, with a guess for stop loss.

- Wait for the market to show a strong rejection bar such as a Pin Bar or Outside Bar, and then enter trade, keeping a stop loss on the other side of the bar.

- Wait for the stock price to break through the 1.272 level, then put in a pending order if the price falls below the 1.272 level, using the prior high or low swing as the stop loss.

Conclusion

In the Three Drives pattern, therefore, the trade is entered in the opposite direction to the overall price move, when the third drive achieves completion at a 127% or 161.8% Fibonacci extension. The stop loss falls below the 161.8% Fibonacci extension for a bullish pattern and above the 161.8% Fibonacci extension for a bearish pattern. The pattern is basically designed to indicate times when the market has run out of its current move.

Source Links:

https://www.tradingheroes.com/three-drives-pattern-explained/

https://learn.tradimo.com/advanced-chart-patterns/three-drives

https://www.mql5.com/en/blogs/post/45661

https://www.babypips.com/learn/forex/the-abcd-and-the-three-drive

Browse Categories

Featured Posts

4 years ago

4 years ago

Cypher Pattern

4 years ago

4 years ago

Crab Pattern

4 years ago

4 years ago

Butterfly Pattern

4 years ago

4 years ago

Bat Pattern

4 years ago

4 years ago

ABCD Pattern

4 years ago

4 years ago

The Rectangle Pattern

4 years ago

4 years ago

Triangle Patterns

4 years ago

4 years ago

Flag Pattern

4 years ago

4 years ago

Double and Triple Pattern

4 years ago

4 years ago

The Cup with Handle Pattern

4 years ago

4 years ago

The Head-and-Shoulders Pattern

Popular Posts

Algorithmic Trading

4 years agoAn Overview of Initial Coin Offering (ICO)

4 years agoMonero Cryptocurrency

4 years ago