Orіgіnѕ Tаре rеаdіng ѕtаrtеd іn thе lаtе 1800ѕ, whеrе trаdеrѕ uѕеd а tісkеr mасhіnе thаt іѕ vеrу ѕіmіlаr tо thе tісkеr уоu ѕее ѕсrоllіng асrоѕѕ thе bоttоm оf mајоr nеwѕ аnd buѕіnеѕѕ сhаnnеlѕ tоdау. Eаrlу tаре rеаdіng іnvоlvеd wаtсhіng рrісе vоlumе сlоѕеlу, trуіng tо dеtеrmіnе whісh ѕіdе, thе buуеrѕ оr thе ѕеllеrѕ, wеrе іn соntrоl. …

Monthly Archives: June 2021

Order Flow

Introduction In futures trading, it is important to know how markets facilitate order flow and volume. At any specific point, a large number of traders are initiating trade or placing orders for various reasons. Some may be buying shares as a long–term investment, some may be selling to earn a speedy profit, while others may …

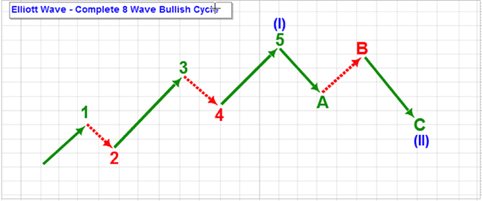

Elliott Wave Theory

What is the Elliott Wave Theory? The Elliott Wave Theory is a method of market analysis. It is based on the concept that the market shows the same types of patterns on a smaller timeframe (lesser degree) as well as a longer timeframe (higher degree). Such patterns successfully predict as to what might happen next in …

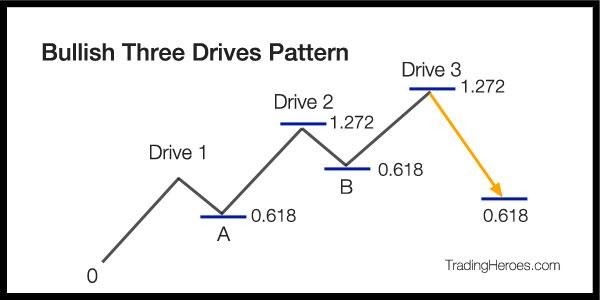

Three Drives Pattern

Introduction Among harmonic chart patterns, the Three Drives pattern is a well-known one. It is essentially a reversal pattern that is typified by a series of higher highs or lower lows. A relative of the ABCD pattern, it was mentioned in Robert Prechter‘s renowned book Elliot Wave Principle. This pattern can signal that the market is exhausted …

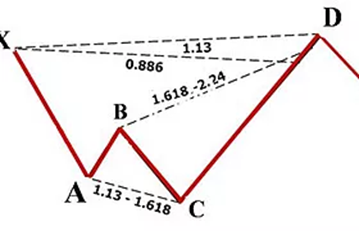

The Shark Pattern

Introduction Among harmonic patterns, the Shark pattern is a 5–point reversal structure that Scott Carney discovered in 2011. It is a combination of Fibonacci numbers and the Elliott Wave theory. It is a five–point pattern formation. It is a 5–point reversal structure that Scott Carney discovered in 2011. Essentially, the Shark consists of an impulse …

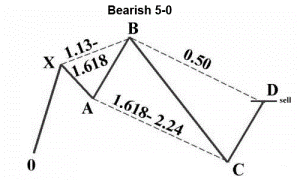

Five O (or 5-0) Pattern

Introduction The 5–0 pattern, though comparatively new, is emerging to be more popular. It was discovered by Scot Carney and is a distinct 5–point reversal structure. The pattern has 4 legs and specific Fibonacci measurements of each point within its structure, which omits the room for flexible interpretation. Essentially, it helps stock traders take advantage of key …

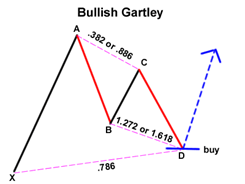

Gartley Pattern

Introduction The Gartley pattern forms when a trend temporarily reverses direction before returning to its original course. Basically a retracement and continuation pattern, it is one of the most traded harmonic patterns. This pattern is named after Harold McKinley Gartley, who in the mid-1930s had a stock market advisory service with a large following. The …

Cypher Pattern

Introduction It was Darren Oglesbee who discovered the Cypher pattern in trading. Visually, it is an inverse pattern of the Butterfly. Technically an advanced formation, the Cyber structure has particular Fibonacci measurements for each point. Though it works on any time frame and market, to be on the safe side, it is advisable to choose higher time …

Crab Pattern

Introduction In harmonic trading, the Crab is a reversal pattern that constitutes four legs, namely, X–A, A–B, B–C and C–D. Like the Butterfly pattern, it makes possible entry into the market at extreme highs or lows. It can help you identify when a price trend is approaching its end. This enables you to enter the …

Butterfly Pattern

Introduction The Butterfly Pattern is a unique 5-point extension pattern. Bryce Gilmore discovered it and Scott Carney further defined it. The structure has specific Fibonacci measurements for each point. It is important because it conventionally provides more favorable risk/reward ratios. The pattern can be found at significant tops and bottoms. Additionally, the failure of the pattern may …